According to the Bureau of Labor Statistics, the U.S. economy is expected to add 1.9 million jobs in leisure and hospitality during the decade ending in 2031.

A newly created master’s degree in hospitality being offered at Fordham this fall will give students a key into the fields of hotel operations, development, and management.

“We all experienced the pandemic when you essentially couldn’t travel, and it really is true that if you tell people they can’t do something, that’s the thing they’re going to want to do the most,” said Joshua Harris, Ph.D., director of the Fordham Real Estate Institute, who oversees the program.

“So we see a lot of demand for hotels and travel demand. There’s a lot of growth.”

Harris said the degree, as well as advanced certificates in Hospitality Investment and Development and Hotel Management, will appeal to people who are interested in managing hospitality properties, as well as those who want to invest in them.

Managing and Investing in Hospitality Properties

Offered through the School of Professional and Continuing Studies they are an obvious expansion for the Real Estate Institute, Harris said.

“Hospitality is one of those areas that is very adjacent to what we are doing, as it is essentially an asset class within the real estate world. It’s a very specialized business type of real estate, but it’s always been a natural extension,” he said.

The course selection reflects that connection. Whereas core courses include Travel and Tourism Studies; Marketing, Branding, and Public Relations; and Food Service Management, electives include courses such as Real Estate Valuation and Investment Analysis; Event Management; and Adaptive Reuse and Sustainability. Courses will be offered in person and online.

The certificates are geared toward someone who wants to focus more specifically on either the operations of a hotel or investing in hospitality-related businesses. In addition to coursework, students will have access to mentorship opportunities in the industry.

Not Just Hotels

Harris said he’s bullish on the field because the principles of hospitality can be applied beyond just hotels. Multi-family apartment complexes, co-working spaces, and even higher education institutions are approaching customers in the same way that hotels have long done.

“Hospitality approaches are embedded into more business and operations than ever. It’s going to be one of the biggest themes in a lot of businesses and how they actually manage this new world between online and impersonal services while also still keeping consumers and people happy,” he said.

To learn more, visit the Hospitality Institute webpage.

]]>As a direct response, Fordham’s Real Estate Institute and the Kyiv School of Economics (KSE) will launch a series of virtual symposia to examine the foundation and future of residential, commercial, and industrial real estate activities in the aftermath of the conflict in Ukraine. The partnership seeks to build an intellectual foundation for a strong and innovative economy of Ukraine as well as develop the real estate services, public policy, and governance needed for a thriving and viable real estate ecosystem.

“Well-trained urban economists and real estate specialists are a fundamental requirement to build a socially inclusive and economically sustainable system of Ukrainian cities. We look forward to welcoming our colleagues from the Fordham University Real Estate Institute and The Counselors of Real Estate in launching new educational initiatives at KSE,” said Mihnea Constantinescu, Ph.D., head of research at the National Bank of Ukraine and visiting scholar and academic director of Kyiv School of Economics’ urban development program.

The first symposium will take place on Feb. 14 at 7 p.m. Eastern European Standard Time (12 p.m. U.S. Eastern Standard Time) on Zoom and will feature a presentation by The Counselors of Real Estate, an international consortium of credentialed real estate problem solvers that has advised towns and cities in the aftermath of destruction.

“This reflects the commitment to cutting-edge thinking and applied knowledge characteristic of these three organizations: Fordham University Real Estate Institute, the Kyiv School of Economics, and The Counselors of Real Estate,” said Neil B. Madsen, CRE, who is a founding principal of Madsen Advisors, LLC; board member of The Counselors of Real Estate’s New York Metropolitan chapter; an adjunct professor at Fordham’s Real Estate Institute; and head of thought leadership on its REI Executive Advisory Council.

The partnership between REI and KSE seeks to build an intellectual foundation for a strong and innovative Ukrainian economy and to develop the real estate services, public policy, and governance needed for a thriving and viable real estate ecosystem. The series aims to work toward solutions to long-standing problems in post-Soviet Ukraine, such as haphazard regional development and unbalanced growth, which will only be exacerbated by the war.

“This collaboration between Fordham REI and the KSE comes at a critical juncture,” said Ryan O’Connor, REI Executive Advisory Council chair and CEO of Clinton Management. “Fordham REI students routinely study the risks inherent to developing the built world. However, black swan events throughout history, such as the war in Ukraine, present unforeseen threats and challenges to those tasked with rebuilding the built world through public policy and governance. This symposium offers a truly unique conversation and is yet another example of the cutting-edge education Fordham REI students can expect.”

“We are thrilled to support KSE in providing their students with knowledge of global best practices in commercial real estate,” said Dr. Anthony R. Davidson, dean of Fordham’s School of Professional and Continuing Studies. “There is great potential in this Fordham REI partnership, and doing our part to ensure Ukraine’s future workforce is prepared to build a robust, post-war real estate market is just the beginning.”

Media Contact: Whitney Bowers, Co-Communications Inc. [email protected]

]]>

The Fordham Real Estate Institute (REI) will offer students and commercial real estate professionals an opportunity to hear first-hand lessons and advice from leaders in real estate in its new series, “Titan Talks.”

The first event, which will take place on Feb. 13, will feature guest speaker Barbara Corcoran, television personality and founder of The Corcoran Group, a luxury real estate brokerage in New York City. All events will be hosted by real estate expert Bess Freedman, CEO of Brown Harris Stevens and member of REI’s Executive Advisory Council (EAC) of industry and business leaders. There will be three events each semester at the McNally Amphitheater at the Lincoln Center campus at 5 p.m.

“I am honored to be the inaugural guest speaker at the Fordham Real Estate Institute’s Titan Talks with Bess [Freedman],” said Corcoran. “The industry continues to evolve rapidly, and it is more important than ever to spread information and knowledge to benefit the next generation of real estate professionals.”

The hour-long programs will focus on examining the industry for its future professionals through the lens of role models like Corcoran, a real estate mogul, frequent columnist and TV commentator, and regular on ABC’s reality show Shark Tank.

Free attendance is offered to Fordham students, with first priority given to those enrolled in REI programs. Additionally, limited seating is available for attendees from the larger real estate community at $30 per person. Attendees will have the opportunity to participate in a Q&A session at the close of the program.

“I’m thrilled to have Barbara Corcoran kick off this series because she is such an industry trailblazer and will share her journey in her own words, including the failures as well as the successes,” said Freedman. “In life—if you can see it, you can be it. Everyone needs to see a path, and this is an opportunity for tomorrow’s real estate leaders to envision one.”

Ryan O’Connor, REI EAC chair and CEO of Clinton Management, agreed.

“It’s really special to invite those just beginning in this field to authentic conversations with titans who will share real and relevant stories,” O’Connor said. “It’s likely our students would not otherwise get the chance to learn from their idols in such a tangible way. I’m really proud to be a part of offering this at Fordham.”

Seating is limited. For more information about the Feb. 13 event, click here.

For information about REI, the Executive Advisory Council, and Scholarship 250, click here.

Media Contact: Whitney Bowers, Co-Communications Inc. [email protected]

]]>Those connections begin with Anthony Pastore, a Fordham faculty member who teaches construction project management courses in PCS’s Real Estate Institute (REI). Outside of the classroom, Pastore serves as a senior vice president at AECOM Tishman, a company that has managed construction for some of the world’s most iconic buildings, including One World Trade Center.

While teaching at Fordham, he met several students who left a deep impression on him, including Arthur Arbaje, a student in the master’s program in construction management, and Timothy Fazzinga, a student in the advanced certificate in construction management program. After they completed their programs this year, Pastore hired them to work on design and construction for the $9.5 billion renovation of JFK Airport Terminal 1.

The airport, which opened in 1948, currently has six terminals. Terminal 1 is the third oldest of the terminals. The revamped terminal, which is expected to be fully completed by 2030, will become the largest terminal at the international airport. It will expand its number of gates from 12 to 23, upgrade its technology and security, and add new amenities with a focus on sustainability.

A ‘Full Circle’ Moment Between a Professor and His Student

The team working on the terminal includes several members of the Fordham community, said Pastore. This year, he hired Arbaje and Fazzinga to work on the project as an assistant project manager and a project engineer, respectively. Pastore said his team has also worked with other Fordham REI graduates and students on the renovation, including Gian Maxino, PCS ’18, an analyst in risk and operations construction management; Yoselyn Torres, PCS ’20, previously an assistant project manager; and Anthony Diodato, PCS ’23, a 2022 summer intern.

‘Fordham Opened the Doors’

Fazzinga said he chose to study at Fordham’s Real Estate Institute because of its affordable, flexible, and comprehensive programs.

“My program helped me to understand how the industry and business is run,” said Fazzinga, who completed his advanced certificate in construction management this summer. “It pretty much covers every aspect: reading construction drawings and documents, project management, estimating and bidding, planning and scheduling, budgets and costs, and field operations.”

Like Pastore, he had previously worked as a carpenter, as well as an assistant project manager for another construction company. In October, he was hired by Pastore to work as a subconsultant for the airport renovation, where he assists managers with building the terminal’s roadways.

“There are a lot of great opportunities in New York,” said Fazzinga, 25, who lives in Somers, New York. “Fordham opened the doors to them.”

Looking for People with ‘That Same Drive’

Pastore said that his students in the Fordham Real Estate Institute remind him of his younger self. He began working in construction as a carpenter who didn’t know much about the industry, so he decided to take a certificate course at New York University’s School of Professional Studies. There, he met an instructor who also served as an AECOM Tishman executive and told him about the company’s projects.

“I thought, ‘Wow, this is pretty cool. I want to work on projects like that.’ So I sent my resume to Tishman and ended up getting an interview,” Pastore recalled. “When they asked me, ‘Why Tishman?’ I told them about the course I took at NYU and how I was inspired by the executive who taught my class.”

Pastore got the job. Now, more than a decade later, he can relate to his recent hires from Fordham.

“I remember my background, working through the trades, being a superintendent, and going to school in the evening, and I respect anyone who does the same. I’m always keeping an eye out for talent and people who have that same drive and interest in the construction industry,” Pastore said. “Now I’ve come full circle. It’s been great to provide that same opportunity that someone else had given me years ago.”

]]>Continued Growth Amidst Crisis

Michael Dowling, GSS ’74, president and CEO of Northwell Health, was at the epicenter of the pandemic when New York state was hit hard last spring. Dowling said that despite the economic fallout, Northwell continues to occupy nearly 20 million square feet of real estate in the state. He added that the institution expects to continue to expand as it has for the past decade, which is at about $1 billion a year.

“Every month we expand and just to give you an idea, we hire between 150 and 200 employees every single week,” he said. “We have a very, very large footprint.”

Dowling said that regardless of the economic sector, the pandemic has accelerated changes that were already underway, mostly due to advances in technology.

“One of the issues for us right now is to figure out how many of our employees will forever be working remotely, will be part-time, or will be full-time,” he said.

He added that even with so many of its employees on the front line, more than 10,000 Northwell staffers continue to work remotely, which has actually increased productivity.

“Those people seem to be happier and the productivity has been enhanced,” said Dowling, who also served as a professor of social policy and assistant dean at the Graduate School of Social Service after he earned his degree. “That raises the question of what does that mean for the real estate side of my business.”

Manage for Today, Lead for Tomorrow

Dowling said though many employees will continue to work from home, it doesn’t mean he will pull back from constructing or leasing space. Rather, he said, the pandemic has provided him an opportunity to replace existing spaces with other functions, consider infrastructure upgrades, and, “obviously,” technology enhancements.

He said Northwell’s overall vision for new construction projects remains the same.

“It’s a temporary blip. You know, it was difficult and I don’t want to minimize it,” he said of the deadly pandemic. “But we will recover from this, … I don’t think it will be the same exactly. But I do think we will come back strong and I think New York will continue to be the city of dreams.”

He added that he expects to rent in Hudson Yards soon, which he described as temporarily “dormant” due to the crisis, though he predicted the site to be “flush” in three to five years.

“I’m always thinking five years away, seven years away,” he said. “You manage for today which will lead for tomorrow.”

Built-In Health Tech

He also predicted that consumers will come to expect certain technological advances they’ve become accustomed to during the pandemic, such as telemedicine, and new construction must accommodate that. They will also expect to be kept safe.

“We also have to build now to make sure that we’re completely adaptable for infection control, safety mechanisms—and that’s not just hospitals, by the way, that’s for all construction,” he said.

Jeffrey Levin, founder and chairman of Douglaston Development/Levine Builders/Clinton Management, reminded viewers that at the beginning of the pandemic people were concerned about touching contaminated surfaces. This led him to consider building projects with an eye toward utilizing technologies so that residents don’t necessarily have to push buttons or open doors.

“You can use your iPhone to call the elevator or open your apartment,” he said. “We’ve already moved over to electronic latches into apartments because people initially wanted that for the ease, but now it’s more for the concept of hygiene.”

Dowling said housing is part of health care.

“Good housing promotes good health,” he said. “I think you’re going to see more and more of an integration between health care delivery systems and housing development.”

Getting Back to the Office

Jennifer Stewart, global head of real estate for BNY Mellon, said that from a workforce perspective the past year was a major test of at-home technological capacity.

“The biggest beta test ever for the technology was when we all had to leave our offices and go work from home,” she said. “It was a tremendous effort, but you know what? We passed the test … And if there’s anything we’ve learned from using this technology, is that it’s made us all more forward-thinking.”

Yet, Stewart said that with vaccines making headway, she senses “a pent-up demand and energy” to get back to work in person, albeit with caution, “once the kids are back in school,” and safety at the office is assured.

“Being able to work in a hybrid way or virtually is an added bonus, it gives people flexibility, and it adds to wellness,” she said. “But at the same time, we’re social beings, so this idea of you can just work from home forever, well I don’t think that any industry, in any way, shape, or form believes that.”

James Nelson, principal and head of Tri-State Investment Sales Group at Avison Young, moderated the discussion that also included industry experts Chris Mills, president and CEO of Plaza Construction, and Marc Zuluaga, CEO at Steven Winter Associates.

]]>Kicking off the series during a global pandemic, the first panel centered on the potential of the industry to become a leader in the nation’s economic recovery by being adaptable to change, creating a more inclusive workforce, and being responsive to the communities in which they build.

The panel, titled “The Real Estate Workforce: Restarting the Engine and Propelling the Economy,” included Dorothy “Dottie” Herman, CEO of Douglas Elliman, New York’s largest residential brokerage, and Don Peebles, a developer and CEO of Peebles Corporation. Joseph M. McShane, S.J., president of Fordham, joined the conversation with moderator Luis Mirando, chair of the institute’s executive advisory committee and founder of Streamline Realty Funding.

Impact of E-Commerce on Retail Real Estate

The event began with a sobering overview of the current economic landscape provided by Hugh Kelly, Ph.D., the institute’s curriculum chair. He reminded listeners that 9 million jobs have been lost over the last year and some industries, such as retail, were already undergoing a sea change well before the pandemic began.

“You know we talk about preexisting conditions in health care? Retail losses expressed a lot of preexisting conditions; this was already an over-supplied sector, it was one that was in transition, under the threat of e-commerce,” said Kelly.

The increased use of companies like Amazon during the pandemic means that retail storefronts may need to be reimagined, he said. E-commerce’s growth has led to a new understanding of essential real estate, such as warehousing. He added that the industry will need to be nimble and responsive to such changes in the market.

Inclusivity Is Good Business

Real estate can help bring about that change at the local and national levels, said Peebles, one of the most successful African American developers in the country who holds a portfolio of more than 10 million square feet worth $8 billion. He added that there is “tremendous expectation” that the industry will be at the forefront of leading the nation out of the current economic downturn, though that leadership must become far more inclusive than it is now, he said.

“Throughout our company’s history we have done over 25% of all of our contracts with minority- and women-owned businesses; our company’s goal is 35%,” he said. “Our driving force here is that it’s good business to be inclusive, you get a better product, you can be much more impactful.”

Listening to Diverse Communities

By the same token, he said, developers also need to listen to the diverse communities that they build in.

“This is the biggest problem in our industry and why we’re so despised in New York City,” he said. “We basically go into communities and occupy them, we gentrify them, and the economic benefits are given to people who come in and leave.”

He added that in one of the most diverse cities in the world, the industry leadership looks as though it comes from a small white city somewhere in the Midwest.

“We are not a part of the communities and we do not reflect the population demographics of New York City, all you have to do is look at the who’s who at the top,” he said of industry executives.

‘Everyone Should Be Able to Get into the Game’

Herman, whose firm is one of the largest nationwide, said she did not have many female role models growing up, as she lost her mother in a car accident when she was just 10.

“I basically grew up on my own and when I went to college I got married and had my daughter by the time I was 20,” she said. “So I needed to make money.”

She became a certified financial planner and got a job at Merrill Lynch in their real estate division which, she said, was still a “good old boys club.”

“I heard the word ‘no’ millions of times, I’ve dealt with gender issues a million times, and I certainly have failed—I could write a book,” she said.

Herman said she started as an entrepreneur with little capital, bus she was able to convince several backers to join her in an effort to buy her first brokerage firm from Prudential, which she would eventually grow to become one of the largest brokerages in the U.S. She touted the importance of networking outside of one’s comfort zone, and also with like-minded women whenever possible. She also stressed the importance of access for everyone.

“It’s not an equal playing field,” she said. “I do think that number one, everybody should have a way to an education. I know as a woman, there are so many single moms who deserve that. Everyone should be able to get into the game.

To that end, the institute launched a scholarship for students from marginalized communities with the goal of raising $250,000 every year for the next five years. The campaign, called the Scholarship 250 Fund, will culminate in 2026 when the U.S. will celebrate its 250th anniversary.

Father McShane agreed with Herman, noting that New York City remains the place where someone from an underserved community or another country can make it to the top of their field, regardless of the industry.

“These are the young women and men who will make America great, the young women and men who made America great all along,” he said. “They’re filled with talent, eager to find their place at the American table, looking, with grit, for a way in.,

]]>“When you go to school it needs your full attention, and with my dad sick I just couldn’t do both,” she said.

Now, 40 years later and just a few credits to go, Lee will be wrapping up her bachelor’s degree this semester and plans to segue straight into a Master of Science in Real Estate at the School of Professional and Continuing Studies. At a time when most of her contemporaries are retiring, while plotting her next chapter—albeit one inspired by the chapter she’s just closed.

A Space for Children with Special Needs

Together with her business partner, Lee owned and operated a pediatric therapeutic services center in TriBeCa. The center had contracts with city and state agencies to provide occupational therapy, speech therapy, and physical therapy for children with special needs. In addition, they provided orthosis (braces) and other supports for children.

“Over the years we lost two leases, one we had for 10 years and another we had for eight years, but the rent doubled so we had to move out. Finally, we were fortunate and we purchased a place on Reade Street, which allowed us to have a secure place for the practice.”

Though the two recently retired from the 25-year-old center, Lee stayed on as a consultant to the new owner, who moved into a new commercial space in TriBeCa. But with COVID-19 and her lease expiring, the new owner decided not to renew her lease. She has been providing therapy services virtually and would like to reopen the center as a therapeutic gym with therapists’ offices and space for the families to socialize. Ideally, she’d like to reopen in TriBeCa, where the practice was established, though the area remains one of Manhattan’s priciest neighborhoods.

“I was going to retire, but I really wanted to go back, get my master’s, and eventually I’d like to the help the new owner get a facility,” said Lee, who currently works as an assistant to an attorney in the Wall Street area.

Given her background of renting and purchasing space in Lower Manhattan, one would think that Lee would have little need for a deeper understanding of real estate, but she said this would be the first time she conceived of the nonprofit venture from the ground up. She is hoping to help the owner get the new center up and operating with real estate expertise she will be learning at Fordham.

Understanding Construction, Financing, and Zoning

“I need to be more knowledgeable about a nonprofit building, even though I’ve learned from experience many years ago,” she said. “But now I need to know how to finance a project like that, how to do the construction, how to work with the zoning, and how to establish the facility with little financial hardship for the new owner.”

The pandemic has provided Lee with time for reflection, she said, noting that the newly vacant storefronts and sudden quiet reminded her of the days following 9/11.

“Back then, when we walked past Canal [Street] it was a different world after the attacks—like day and night,” she said.

A New Therapeutic Center for a Challenging Time

“I had the time to think about what I can do to contribute, knowing that the business is still going,” she said, adding that she finds herself in the same frame of mind now. “I really thought about how things have changed during COVID, and how I really want to be able to have something, directly or indirectly, for the families.”

She hopes the practice she helped build can be reimagined as a new kind of supportive center for children and families.

“If we can help families find a place where they can go and the children have support, then we’ve created a space for tomorrow’s leaders,” she said.

Last month, Lee was taking midterms to complete her bachelor’s. She’s taking a class on social problems in America and she was also able to take a master’s level course in real estate law that’s available to students pursuing a bachelor’s in real estate. While she said the law midterm was tough, she was later thrilled to report that she did well on her first exam in decades. But she said it was the course on social issues that steeled her resolve.

“A special needs child may need a lot of help, but I believe we should all have the support and opportunity to make things better for others,” she said. “Any mom or dad that needs us, we’re going to be there to help them out.”

]]>

“As with racial justice, as with climate change, when it comes to public health crises, cities tend to be on the frontlines,” said Nestor Davidson, the Albert A. Walsh Chair in Real Estate, Land Use, and Property Law and faculty director at the Urban Law Center.

Davidson said that one set of questions the Urban Law Center looks at, particularly in times of crisis like this, are those of authority and power.

“Who can act? Who is prevented from acting? What levels of government take responsibility for what kinds of things?” he said. “Even though it’s still early, one of the emerging lessons from the pandemic is that we have a system of federalism that isn’t necessarily as well-suited as it could be to responding to this kind of a crisis. We’ve had an incredibly fragmented response.”

Even though cities are often the first to grapple with “an issue like a pandemic, and it’s often where the effects of crises like this are felt most deeply,” Davidson said city leaders are sometimes challenged when it comes to their authority to act.

“We’ve had conflicts where cities have wanted to take more aggressive steps to protect public health, and you’ve had some states preventing that, and some states reversing course now,” he said.

Overcrowding vs. Density

Annika Hinze, Ph.D., director of Urban Studies at Fordham, said that while there’s no question New York City in particular was dramatically impacted by the pandemic, neighborhoods with overcrowding, or a high number of people per household, bore the brunt of the crisis more than those that are simply considered densely populated areas, containing high-rise, residential buildings.

Using data collected by the Furman Center at New York University, Hinze was able to analyze how different neighborhoods were impacted by the pandemic as well as the impact on certain demographic groups, such as those determined by race and economic status. She found that those in overcrowded situations, likemultiple people living in tight quarters, had higher rates of infection than those living in densely populated areas where overcrowding is not as common.

“The neighborhoods with the highest density in New York City had almost half of the infection rate of those with lower densities, meaning that Manhattan, which is the densest borough in the city, had the lowest infection rates of all five boroughs, and that the outer boroughs, especially Queens and the Bronx, had severely higher infection rates than Manhattan,” she said. “So housing density seems to not be the culprit with COVID-19 infection rates; it was overcrowding.”

Hinze has been working to analyze how overcrowding has contributed to the virus’s spread in other areas of the country. She’s been collecting data from Finney and Ford counties in Kansas, which are home to meatpacking plants, as well as data from Tulare and Kern counties in California, which are home to many agricultural workers. While she’s still collecting the Kansas data, the California data has shown that areas where workers live in tight quarters also have higher rates of infection.

“There was definitely a correlation between overcrowding in the census data and COVID-19 infection rates. Tulare and Kern counties, they’re among the most rural counties in California, yet they were as of June, number 8 and 11 respectively in the state for COVID-19 infections,” she said.

Social Distancing: ‘A Luxury Good’

One of the reasons why parts of cities with overcrowding have seen higher rates, according to Hinze, is because some of the best measures to combat COVID-19, including social distancing and easy access to hand washing, hand sanitizer, and other cleaning products, aren’t possible.

“I think social distancing in many ways is a luxury good, and maybe we’ve been talking about this too little as a country,” she said. “If we look at the numbers for New York City, [the highest number of cases]are in many poor and immigrant neighborhoods in Queens and in the Bronx where people don’t have, essentially, the luxury of social distancing.”

By contrast, some of the wealthiest city dwellers were able to take social distancing measures a step further and move out of the urban areas, at least temporarily, Davidson pointed out.

“Cities are great engines of growth and innovation and economic power and that’s become increasingly true as our society has kind of shifted in a post-industrial way,” he said. “At the same time, they’re places of great inequality, and again, something like a pandemic shines a very bright light on pre-existing inequality … certainly in a time when statistics show that, over time, more than 400,000 New Yorkers have left the city.”

The Cost of Leaving

Hugh Kelly, Ph.D., CRE, the chair of the Fordham Real Estate Institute, cautioned against people seeking “long-term” solutions, like moving, to “short-term” problems.

“If it made sense pre-COVID, then why wouldn’t you have done it pre-COVID?” he said.

While Kelly said that he expected the real estate market, particularly in cities, to take a hit in the near future due to social distancing and other public health guidance, he didn’t expect those trends to continue long-term.

“In the near-term, it’s clear that things like density, mass transit dependence, high-rise building forms are disadvantageous in the midst of the height of the pandemic,” he said. “For the short-term, metropolitan areas that are more sprawling, more low-rise, automobile-dependent, and have the ability to have the built-in equivalent of social distancing have the advantage and that’s probably the case for the next 12 months or so.”

Premature Predictions of the “Death of Cities”

But Kelly said that he believes that after we’ve adjusted to living with social distancing measures, or once effective treatments and vaccinations are available, the characteristics of cities that made them appealing in the first place will still be thee.

“The elements that have made for the most vibrant and the most successful cities … are going to reassert themselves,” he said. ‘The vibrancy that comes with businesses and people interacting with each other—that’s what promotes innovation. Innovation produces productivity and productivity produces profits and that’s what attracts businesses and people to places to work.”

Both Davidson and Kelly said they’ve seen the predictions that this will be the “death of cities” before, including after the 9/11 terrorists attacks at the World Trade Center.

This same round of articles was written after 9/11, Davidson said, noting that after the city rebounded, there were also conversations about too many people wanting to live there. And those are really problems as well. We have to think about housing affordability, and we have to think about unequal access to opportunity, and all the real challenges in cities that are successful.”

Looking Toward a Better Future

Cities won’t look exactly the same as they did before the pandemic, the professors said, as they tend to take something from each of the crises they endured.

Hinze said she hopes that policy makers see how crowded dwellings and other symptoms of inequality have been exacerbated by the pandemic, and that they look to address them in the future.

“It’s most important,” she said, to “make sure that people do not live in these conditions and to sort of provide them with enough of a social safety net so they can live in conditions that are safe,” she said.

Other aspects of life in the city will also likely see some major changes. New York City Mayor Bill de Blasio, for example, announced on Aug. 3 that the Open Restaurants initiative, which allows restaurants to take over certain streets and sidewalks for outdoor dining, will return next summer.

“You think about ways in which cities are repurposing public space, and taking advantage of a moment where cars haven’t been as dominant a part of the landscape at the local level. Maybe that means we’re going to have more walkable cities, maybe that means we’re going to have a greater embrace of the importance of public space,” Davidson said.

Kelly said from a real estate perspective, he could see offices refitting themselves to allow more space per employee, as well as apartments getting reconfigured to allow for some type of work-from-home model.

“There’s a sea change in that the square footage per employee, which has been going down for about 25 years, begins to reverse itself and becomes a larger space allocation,” he said.

He added that shared office spaces like WeWork will probably no longer appeal to people because social distancing would be too complicated.

Kelly pointed to one major sign he’s looking for to know that New York City has fully re-emerged—food trucks.

“When the food trucks are back on the street, people are coming back,” he said. “It means two things. That there are enough people coming into the central areas to support those food trucks and, even more, the food truck operators feel that they can do so safely.”

]]>

Now, a course in the School of Professional and Continuing Studies’ Real Estate Institute master’s program, titled Real Estate Development and Feasibility Study, gives students a real-world taste of what it’s like to propose a commercial real estate project to the community. The course was developed by instructor Serge Reda, GABELLI ’04, who has 18 years of experience in commercial real estate development. He also teaches a course on real estate capital markets for the Gabelli School of Business.

“I’m really interested in changing people’s perception of what they think real estate development is,” said Reda. “My message is you can make a lot of money, still listen to the community, and think about the project’s legacy—like what’s right for the next 100 years.”

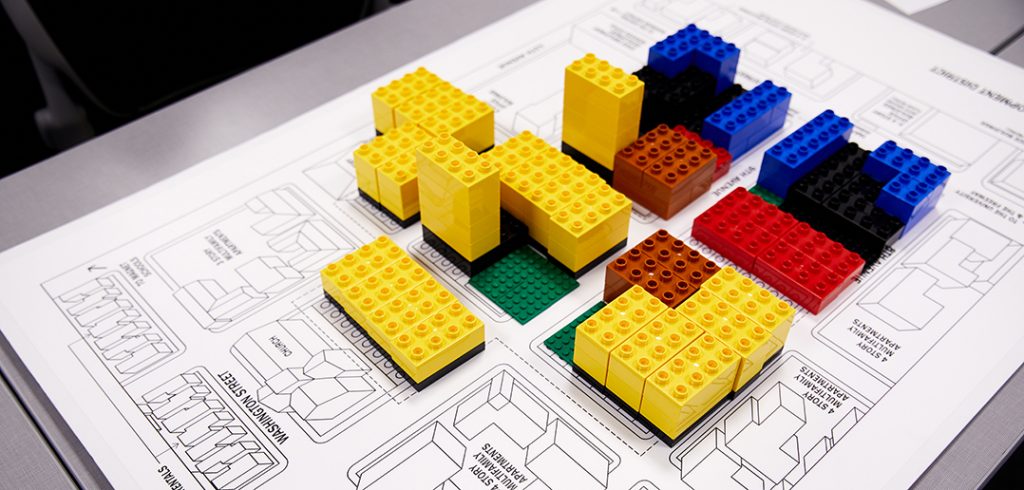

To create the course Reda collaborated with the Urban Land Institute’s (ULI) New York to incorporate ULI’s UrbanPlan program. ULI, a nonprofit that seeks to encourage responsible land use alongside sustainable community, created the 15-hour curriculum for students to address the multipronged effort it takes to build in a city like New York. But for the sake of the class, students build their developments in a fictional town called “Elmwood.”

The exercise sets up two development teams of five students each. Students are assigned roles: a site planner, financial analyst, marketing director, city liaison, and neighborhood liaison. The city, “Elmwood,” has put out a request for proposals, and the two teams must put together a vision statement, build a financial model, and a site model. In the five weeks it takes to complete the course, trained volunteers from ULI New York come in as facilitators to walk students through their plans and help them understand what it’ll be like to present to city hall. In the fifth session they present to a mock city council, when still more ULI volunteers step in to play the role of councilmembers at the hearing.

“It’s about as real as it could possibly get without actually going to the City Council,” said Reda, who is a ULI member and has been a volunteer facilitator.

The master’s level program was developed by ULI at the University of California, Berkeley; Fordham is the first university to use it in New York City.

“Graduate level students often study different areas of real estate development and operate in silos without a true understanding of how the various development roles relate to each other until they enter fulltime in the profession,” said Sofia Guerrero, Senior Manager for ULI New York, who oversees UrbanPlan locally.

“The mission of UrbanPlan is to create those connections on the fundamentals of real estate development in a fun hands-on way,” said Guerrero. “What’s different than a regular class is that they’re working in teams, which they often don’t learn how to do until they enter the workforce.”

Guerrero said that the professional volunteers, who she helps coordinate, take the challenge very seriously and also benefit from the role-playing.

“It really depends on their personal character, but sometimes they can be quite the actors,” she said.

Reda said that as the master’s in real estate program has grown, the teams have also grown more robust.

“It definitely makes it a more competitive and exciting process,” he said. “It’s also a very diverse student group at Fordham, which you don’t always see at graduate-level programs.”

]]>

“You know that kid on your block who was older than you and was great at sports, who had a great dog that he didn’t have to walk on a leash, who everybody wanted to be when they grew up? He wore that jacket,” says Gulotta, who grew up in Queens, “and that’s when I first came to know of Fordham.”

Gulotta went on to graduate from Fordham College at Lincoln Center in 1982 and, after two years, returned to Fordham for law school. Now a Manhattan real estate attorney with his own firm and the founding CEO of a data protection company, he shares his love of Fordham with others through teaching and mentorship.

Gulotta says he was drawn to real estate law because it allows him to work on a transaction with a client from start to finish. And it was particularly important for him to start his own firm because he wanted to create his own culture—a culture inspired by one he found within the Fordham community.

“I wanted to create my own soil, if you will, where I could blossom the most” and help employees and clients do the same, Gulotta says. “As a businessperson, I don’t want to take advantage of people. I want to invest in my employees and let them know I am loyal to them so they too could thrive. And I wanted to figure out what my clients were going to want before they asked for it.”

That’s what drove him to co-found Real Estate Data Shield in 2012. He had noticed a big compliance gap in the mortgage industry: Banks and other lenders regularly share consumers’ non-public personal information (Social Security numbers, tax records, etc.) with title companies, attorneys, and other third-party vendors—not all of whom adhere to the same strict laws when it comes to safeguarding consumers’ data.

His response wasn’t what one might expect. Instead of developing a technological solution, he helped create a compliance and information security training program specifically tailored to the real estate industry. “That’s because the single greatest risk factor in any kind of information security is the human,” he says. “Depending on the study you read, about 40% of all incidents can be traced back to human misfeasance or malfeasance.”

It’s what he’s best known for in the field, and it’s an insight he shares with his students at Fordham’s Real Estate Institute, where he teaches a course on legal concepts in real estate. The institute, founded in 2016, offers an M.S. and several graduate and professional certificate programs in real estate finance, development, and construction management. “I love working with the students,” he says. “For most of them, it’s their first Fordham experience. And I get to give them guidance and mentorship, to bridge the gaps and actually get down in the trenches and coach them in a personalized way, just as my Fordham professors coached me.”

He brings that same mindset to the Fordham Mentoring Program, where he has been volunteering for 10 years. Each year he is paired with a new mentee, but he’s also done training sessions for his fellow mentors. His biggest tip? “I tell them that before you start offering advice, listen. Really listen and understand who you’re working with, what their strengths and weaknesses are, what their aspirations are, and what they need from you” he says. “Build trust and be a good listener.”

He is proud to have played a small role in how the 15-year-old program has blossomed, growing from just a few dozen mentors in its first year to more than 200 today. Gulotta has been most impressed with the addition of new events like speed interviewing and social outings, where mentors and mentees can bond.

While he has remained connected to all of his previous mentees in some way, he has formed a particularly strong bond with his first: Brandon Brown, GABELLI ’10, who was recently promoted to director of pro scouting for the Philadelphia Eagles.

“Chris was like a sounding board for me,” Brown says of Gulotta’s role in helping him figure out his next steps when he realized he wouldn’t have a playing career in the NFL. “He was like, ‘Hey, can I help you think through that?’ He wasn’t pushing. That’s where I think the foundation for a long-term relationship was built for us.

“I don’t even consider him a mentor anymore,” Brown says. “I consider him a family friend who I lean on heavily for advice.”

Gulotta says he gets more out of working with each student than he ever anticipated.

“You know, there’s a counterintuitive reward from giving. You think if you give something, you have less, because you just gave something away,” he says. “But it actually comes back in spades.”

Fordham Five

What are you most passionate about?

In business, always focusing on being relevant and being known for doing it right.

In my family life as a husband, father, son, et cetera, I’m most passionate about understanding how to best support those I care most about—being mindful of giving them what they need, the way they need it, as much as possible.

And, on a very personal level, it’s two things. The first is staying calm enough, through all the stress and multitasking, so as to let those great realizations form or emerge and not rush into bad decisions. It’s the Xing Yi concept of “no mind,” erasing the cluttered blackboard that is our mind so these great ideas can present themselves. And the second is challenging myself physically, being willing to see and feel my limits and working to see those measures change, hopefully for the better.

What’s the best piece of advice you’ve ever received?

Actually, there are a few, but two are from Father John Adam, who taught me at Fordham: “Life doesn’t work if you don’t keep your promises.” And “The mind is like a parachute; if it’s not open, it doesn’t work.” I think he meant the first one just as much about yourself as about others. We all have rationalizations to get through the day, but if we really start lying to ourselves, life just doesn’t work. The second piece of advice was just very vivid and stuck with me. It reminds me to be as open-minded as possible.

What’s your favorite place in New York City? In the world?

In New York City, it would be either Central Park or Riverside Park. Both offer incredible views, allowing us New Yorkers the opportunity to find calm, run, bike, walk, visit with friends, and get some balance from all the stress we find in the other parts of NYC.

In the world, it would be a toss-up between Cathedral Brook, which is a remote ski trail at Belleayre Mountain in New York, and Northern Italy’s Val D’Aosta. It’s lined with former Roman forts (now museums and inns), has gorgeous, glacier-fed, fast-flowing rivers, and the Nebbiolo grape is happy there.

Of course, any mountain, beach, forest, greenway, or my living room with my family and pooches also works.

Name a book that has had a lasting influence on you.

This is the toughest question you’ve asked. At 21, in my senior year at FCLC, I took a course called Philosophy of the Absurd with Professor Bernadette Bucher, who was born and raised in France. She had actually studied under Jean Paul Sartre. Assigned readings included Albert Camus’ “The Myth of Sisyphus,” written during the Nazi occupation of France.

We all know the story of the Greek myth. Sisyphus had been naughty, and the gods had sentenced him to pushing a boulder up a hill, only to have it roll back down each day—an eternity of hopeless struggle. Yet Camus tells us that he envisions Sisyphus happy or content, for he has accepted his fate and his struggle. And in doing so, he rises above it and has ultimately found contentment.

Life throws a lot of curveballs at us, both good and bad. It’s tempting to give up or think we’re victims. Facing challenges—understanding that the sooner we start trying to tackle them, the better off we are—and then smiling at and accepting the course of our journey was my personal takeaway.

Who is the Fordham grad or professor you admire most?

This is the easiest question, but I cannot answer it without mentioning both the Fordham grad and professor I admire most.

The Fordham grad would be my very first mentee, Brandon Brown. Nearly 10 years ago, he was a young man on a football scholarship at Fordham. In his junior year, he realized that for various reasons the NFL draft wasn’t a likely possibility for him. It was a sad realization for a truly gifted athlete who worked tirelessly since he was 10 years old on his fitness, technique, and understanding of the game. Yet he pulled himself up by the bootstraps, accepted this new reality, improved his academics, attended law school, and found his way back to his true passion as a football scout for Boston College. Within two years he moved up to the NFL as a scout for the Indianapolis Colts and was later recruited by the Philadelphia Eagles, where he now plays an integral role for the 2018 Super Bowl champions as the director of pro scouting.

Most mentor-mentee stories involve the mentor inspiring the mentee. But thankfully, in this instance, Brandon’s constant pushing of that boulder up the hill has and continues to inspire me.

As for Fordham professors, both Father Adam and Professor Bernard Gilligan, one an actual Jesuit and the other a virtual Jesuit, demonstrated a level of care, kindness, and joy in their teaching craft by helping scores of Fordham students like myself learn how to think, how to question, how to articulate, and how to reason. They are the embodiment of what makes Fordham special for me and are the very reason that I mentored Brandon and scores of great young women and men—and will joyfully continue to do so.

]]>What attracted you to real estate?

Initially, it was just the thought of investing. It was about taking an idea and putting your money where your mouth is, so to speak, and having that idea be successful. Real estate is something that’s tangible, something that can affect people’s lives on a daily basis. I thought the whole built environment is an interesting space to take part in and something that I would enjoy doing.

You’d been working in the field for a while. What technical skills did you gain from this master’s program that you might not have had before?

My track was a lot of cash flow models. There was one class called Real Estate Valuation and Investment Analysis that went through different investment scenarios, from development to buying a piece of land or buying a building. Then there was also the study on the debt side, including loan underwriting and investments across asset classes. It helped me understand how to value properties.

How much time did it take?

I took 12 credits my first semester, 15 the second, and then nine in the third. The 15 was really hard. It was in the middle of the summer and I was working about 30 hours a week, so it was tough having a social life. But it’s something I really wanted to do. It was worth it. It was fun going to class. I enjoyed doing it.

Now you work in property valuation and advisory with a pretty big firm; is that where you knew you were going to go after the master’s?

I feel like the M.S. in Real Estate gave me a pretty good base to go in a lot of different directions. I definitely could have gone into debt or equity. But the way I got the job was actually through the Fordham Portal. We had one specific for the master’s students in the real estate program and there was a job posting for a company that one of my professors worked at, so I talked to him about it. He spoke highly of the company.

In your current role as a real estate valuation professional, do you focus on commercial or residential property markets?

Commercial. One of my favorite classes at Fordham was the Real Estate Valuation and Investment Analysis course. Basically, what we did was just value different properties and value different deals. That’s what was the most fun for me, just looking at different properties and understanding what was going on with each one within the market.

Give me an example.

Well, I can give you the one I’m working on right now. It’s a parking garage portfolio. I never valued a parking garage before but it’s kind of interesting because they’re in L.A., and there are a couple in Cincinnati, so it’s understanding what is going on in those two markets and then coming up with the value. The one in Cincinnati is right outside of the NFL stadium and the MLB stadium, so that was a big factor.

The Real Estate Institute has a lot of working professionals teaching. How do adjunct faculty from the industry impact your learning? Do you feel you got the right mix of concepts, theory, and professional practice?

We had instructors who took a very academic approach when needed and that was great, but the majority of them as experts in their field spoke about their own experiences and what they were doing at that time. One professor was great, he talked about how he recently got a contract for a specific building and was saying what he would do with that building once he started managing it. He could speak to what he was doing on a daily basis. It’s two different teaching styles, but there was definitely a good balance between the theoretical and application to the real world.

]]>